Investing in Bitcoin with your IRA or crypto 401(k) can be a great way to diversify your retirement portfolio and potentially benefit from the growth of cryptocurrencies. One popular option is to use a self-directed IRA, which allows you to invest in alternative assets like Bitcoin. By setting up a self-directed IRA with a reputable custodian that supports cryptocurrency investments, you can transfer funds from your traditional IRA or 401(k) into a Bitcoin investment.

Another option is to explore crypto-focused IRAs offered by some financial institutions. These specialized retirement accounts are designed specifically for investing in cryptocurrencies like Bitcoin. They typically provide a user-friendly platform for buying, selling, and storing digital assets within the tax-advantaged structure of an IRA or 401(k). However, it's important to do thorough research and consult with a financial advisor before making any investment decisions to ensure it aligns with your overall financial goals and risk tolerance.

Investing in Bitcoin through your IRA or crypto 401(k) can be a smart way to diversify your retirement portfolio and potentially capitalize on the growth of the cryptocurrency market. One of the best ways to invest in Bitcoin with these accounts is through a self-directed IRA. This type of account allows you to have more control over your investment choices, including the option to invest in cryptocurrencies like Bitcoin. By setting up a self-directed IRA, you can choose a reputable custodian that specializes in alternative investments and has experience with cryptocurrencies.

Another effective way to invest in Bitcoin with your retirement accounts is through a crypto 401(k) plan offered by select providers. These plans allow employees to allocate a portion of their 401(k) contributions towards cryptocurrency investments, including Bitcoin. Before investing in Bitcoin through either of these avenues, it's crucial to do thorough research and understand the risks involved. Cryptocurrency markets are highly volatile, and prices can fluctuate dramatically within short periods, so it's important to only invest funds that you can afford to lose.

In conclusion, investing in Bitcoin with your IRA or crypto 401(k) requires careful consideration and strategy. It is essential to work with experienced professionals who understand the nuances of cryptocurrency investing and can help you navigate this complex market successfully. By taking a proactive approach and staying informed about developments in the cryptocurrency space, you can make informed decisions that align with your long-term financial goals while maximizing potential returns from investing in assets like Bitcoin within your retirement accounts.

Understanding IRA and crypto 401(k)

Investing in Bitcoin through your IRA or crypto 401(k) can be an excellent way to diversify your retirement portfolio and potentially benefit from the growth of the cryptocurrency market. To invest in Bitcoin through your IRA, you would need a self-directed IRA account, which allows for alternative investments like cryptocurrencies. With a self-directed IRA, you have more control over where your funds are invested and can choose to allocate a portion towards Bitcoin.

On the other hand, some companies now offer crypto 401(k) plans that allow employees to allocate a portion of their retirement savings into cryptocurrencies like Bitcoin. These plans typically involve working with a financial advisor who specializes in digital assets to help navigate the complexities of investing in cryptocurrencies within a retirement account. It's important to carefully research and understand the risks associated with investing in Bitcoin through these retirement accounts, as the cryptocurrency market can be highly volatile.

Overall, whether you choose to invest in Bitcoin through your IRA or crypto 401(k), it's crucial to stay informed about market trends and seek guidance from financial professionals to make well-informed investment decisions that align with your long-term financial goals. By understanding the intricacies of IRAs and crypto 401(k)s, you can leverage these accounts effectively to potentially grow your wealth through exposure to the burgeoning world of digital assets like Bitcoin.

Investing in Bitcoin with your IRA or crypto 401(k) can be a great way to diversify your retirement portfolio and take advantage of the potential growth in the cryptocurrency market. One option is to open a self-directed IRA or 401(k) that allows you to invest in alternative assets like Bitcoin. By doing this, you have more control over your investments and can choose to allocate a portion of your retirement funds into cryptocurrencies.

Another approach is to invest in a Bitcoin exchange-traded fund (ETF) through your IRA or 401(k). This allows you to indirectly invest in Bitcoin without actually owning the cryptocurrency itself. ETFs can provide exposure to the price movements of Bitcoin while offering some level of diversification and risk management.

Before investing in Bitcoin with your retirement account, it's important to consult with a financial advisor who is knowledgeable about cryptocurrencies and retirement accounts. They can help you navigate the complexities of investing in Bitcoin through an IRA or 401(k) and ensure that it aligns with your overall financial goals and risk tolerance.

Benefits of investing in Bitcoin

Investing in Bitcoin through your IRA or crypto 401(k) can be a strategic way to diversify your retirement portfolio and potentially benefit from the growth of the cryptocurrency market. One of the key benefits of investing in Bitcoin with these retirement accounts is the tax advantages they offer. By using an IRA or crypto 401(k), you can potentially defer taxes on any capital gains until you start making withdrawals in retirement, allowing your investment to grow tax-free.

Another advantage is the potential for high returns that Bitcoin has historically offered. While it's important to note that cryptocurrencies are inherently volatile and come with risks, many investors see Bitcoin as a long-term investment opportunity with significant upside potential. By incorporating Bitcoin into your retirement account, you can align your investment strategy with the growing trend towards digital assets and blockchain technology, potentially capturing gains from this emerging market.

Investing in Bitcoin through a self-directed IRA or a crypto 401(k) can offer numerous benefits for individuals looking to diversify their retirement portfolios. One of the key advantages is the potential for significant returns on investment, as Bitcoin has historically shown strong growth and resilience compared to traditional assets like stocks and bonds. By allocating a portion of retirement funds into Bitcoin, investors may be able to take advantage of the cryptocurrency's upward price trajectory and capitalize on its long-term value appreciation.

Moreover, investing in Bitcoin within an IRA or crypto 401(k) allows individuals to enjoy tax advantages such as deferring capital gains tax until retirement age or potentially even benefiting from tax-free gains if held in certain types of accounts. This tax-efficient strategy can help maximize the growth potential of one's retirement savings while taking advantage of the increasing mainstream acceptance and adoption of cryptocurrencies like Bitcoin. Additionally, incorporating Bitcoin into a retirement account offers a level of security and peace of mind, as it provides exposure to an innovative asset class with the potential to act as a hedge against inflation and economic uncertainties that may affect traditional investments. Overall, investing in Bitcoin with an IRA or crypto 401(k) presents a compelling opportunity for those seeking long-term financial growth and flexibility in managing their retirement funds.

Options for investing with retirement accounts

Investing in Bitcoin with a Traditional IRA or a crypto 401(k) can be an attractive option for those looking to diversify their retirement portfolio. One way to invest in Bitcoin with these accounts is through a self-directed IRA, which allows you to have more control over your investment choices. By setting up a self-directed IRA, you can allocate funds towards purchasing Bitcoin directly or investing in cryptocurrency-related funds. This option gives you the flexibility to capitalize on the potential growth of the cryptocurrency market within the confines of your retirement account.

Another avenue for investing in Bitcoin with your retirement account is through a Bitcoin IRA, which is specifically designed for holding digital assets like Bitcoin. With a Bitcoin IRA, you can transfer funds from your existing retirement account into an IRA that holds cryptocurrencies. This option provides a seamless and secure way to add exposure to Bitcoin within your retirement savings strategy. Additionally, some platforms offer the ability to earn interest on your cryptocurrency holdings, providing potential passive income streams for your retirement accounts.

When considering how to invest in Bitcoin with your IRA or crypto 401(k), it's important to weigh the risks and benefits associated with this volatile asset class. While investing in cryptocurrencies can offer high potential returns, it also carries significant risks due to its price volatility and regulatory uncertainties. Therefore, it's crucial to do thorough research and consult with financial advisors who specialize in alternative investments before making any decisions regarding allocating funds towards Bitcoin within your retirement accounts. Ultimately, finding the best way to invest in Bitcoin with your IRA or crypto 401(k) requires careful consideration of all available options and understanding of the unique characteristics of this evolving asset class.

Investing in Bitcoin with your IRA or crypto 401(k) can be a great way to diversify your retirement portfolio, but it's important to do so cautiously. One option is to use a self-directed IRA, which allows you to invest in alternative assets like cryptocurrencies. By setting up a self-directed IRA with a reputable custodian that supports cryptocurrency investments, you can buy and hold Bitcoin within the tax-advantaged structure of your retirement account.

Another option is to explore crypto-friendly retirement account providers that offer specialized accounts for investing in digital currencies. These providers often have platforms that make it easy to buy and sell Bitcoin directly from your retirement account, while still maintaining compliance with IRS regulations. Before making any decisions, be sure to research the different options available and consult with a financial advisor to determine the best approach for your individual situation.

Risks and considerations Investing in Bitcoin with an IRA or crypto 401(k)

Investing in Bitcoin with an IRA or crypto 401(k) can be a lucrative option, but it also comes with its own set of risks and considerations. One of the best ways to invest in Bitcoin through these retirement accounts is by using a self-directed IRA or 401(k) that allows for alternative investments like cryptocurrencies. This gives you more control over your investment choices and the flexibility to diversify your portfolio beyond traditional assets.

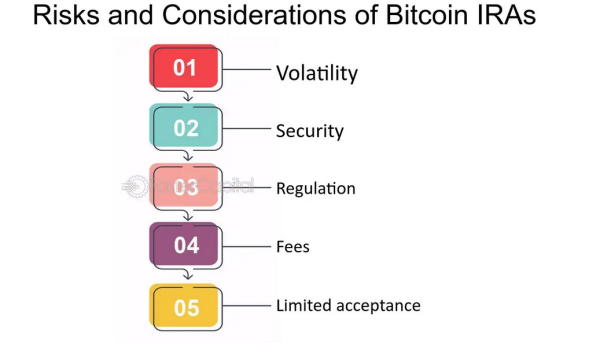

However, it's important to be aware of the risks involved in investing in Bitcoin, such as its volatility and regulatory uncertainties. Cryptocurrency prices can fluctuate significantly in a short period of time, so it's crucial to have a long-term investment strategy and be prepared for potential losses. Additionally, make sure to do thorough research on reputable cryptocurrency exchanges and storage options to safeguard your investment from security threats. Overall, investing in Bitcoin with your IRA or crypto 401(k) can be a promising opportunity, but it's essential to proceed with caution and consider all the risks involved before making any decisions.

Investing in Bitcoin through an IRA or crypto 401(k) can be an exciting opportunity for those looking to diversify their retirement portfolio. However, it is important to consider the risks and potential pitfalls associated with this type of investment. One of the main considerations is the volatility of the cryptocurrency market – prices can fluctuate rapidly, leading to significant gains or losses in a short period of time. It is crucial to be prepared for these fluctuations and have a long-term investment strategy in place.

Another risk to consider when investing in Bitcoin through a retirement account is security. Cryptocurrencies are stored in digital wallets, which can be vulnerable to hacking and cyber attacks. It is essential to choose a reputable custodian for your IRA or crypto 401(k) that offers robust security measures to safeguard your investment. Additionally, regulatory uncertainty surrounding cryptocurrencies could impact their value and legality in the future. Keeping up-to-date with changing regulations and compliance requirements is vital when investing in Bitcoin through a retirement account.

Overall, while investing in Bitcoin through an IRA or crypto 401(k) can offer potential rewards, it also comes with risks that should not be overlooked. Conducting thorough research, understanding the market dynamics, and consulting with financial advisors can help mitigate some of these risks and make informed investment decisions. By carefully weighing the risks and considerations involved, investors can navigate the volatile world of cryptocurrency investments effectively while maximizing their chances for long-term financial growth within their retirement accounts.

Choosing a reputable custodian or platform

Investing in Bitcoin through your IRA or crypto 401(k) can be a smart move for those looking to diversify their retirement portfolio. One of the most important factors to consider when deciding how to invest in Bitcoin with your retirement account is choosing a reputable custodian or platform. A reputable custodian will not only ensure the security of your funds but also provide you with the necessary tools and resources to make informed investment decisions. It is essential to research different custodians and platforms, read reviews, and compare fees before making a decision.

When selecting a custodian or platform for investing in Bitcoin with your retirement account, it is crucial to look for one that has a solid reputation in the industry. A reputable custodian will have strong security measures in place to protect your assets from cyber threats and fraud. Additionally, they should offer excellent customer service and support to assist you with any questions or concerns you may have about investing in Bitcoin through your retirement account. By choosing a trustworthy custodian or platform, you can have peace of mind knowing that your investments are safe and secure.

In conclusion, the best way to invest in Bitcoin with your IRA or crypto 401(k) is by selecting a reputable custodian or platform that prioritizes security and transparency. Investing in cryptocurrencies can be risky, so it's essential to work with a trusted partner who can help guide you through the process and safeguard your assets. Take the time to do thorough research on different options available and choose one that aligns with your investment goals and risk tolerance. By taking these steps, you can confidently navigate the world of cryptocurrency investments within your retirement accounts efficiently while minimizing potential risks.

Tax implications and regulations Investing in Bitcoin through your IRA or crypto 401(k)

Investing in Bitcoin through your IRA or crypto 401(k) can be a strategic way to diversify your retirement portfolio, but it's important to consider the tax implications and regulations involved. One of the best ways to invest in Bitcoin with these retirement accounts is through a self-directed IRA, which allows you to have more control over your investments. By setting up a self-directed IRA specifically for cryptocurrency investments, you can potentially benefit from the growth of Bitcoin while still enjoying the tax advantages of an IRA.

However, it's crucial to be aware of the IRS regulations related to cryptocurrency investments within retirement accounts. For example, any gains made from trading or selling Bitcoin within an IRA are generally tax-deferred until distributions are taken in retirement. Additionally, it's important to ensure that your chosen custodian for the self-directed IRA is experienced and knowledgeable about handling cryptocurrency investments to avoid any potential issues with compliance and reporting requirements. Overall, investing in Bitcoin through a self-directed retirement account can offer opportunities for growth and diversification, but it's essential to navigate the tax implications and regulations carefully for a successful investment strategy.

Conclusion

In conclusion, investing in Bitcoin through a self-directed IRA or a crypto 401(k) can offer significant opportunities for diversification and potential growth. As the cryptocurrency market continues to evolve and gain mainstream acceptance, incorporating digital assets into your retirement portfolio could prove to be a strategic move for long-term financial planning. However, it's essential to approach this investment avenue with caution and conduct thorough research to understand the risks involved.

Moreover, by leveraging the tax advantages of retirement accounts, investors can optimize their gains from Bitcoin investments while deferring taxes until distribution. This tax-deferred growth potential presents a unique advantage that traditional investment vehicles may not offer. Ultimately, whether you choose to invest in Bitcoin through your IRA or 401(k), staying informed about regulatory changes, market trends, and security practices remains crucial for making informed decisions and maximizing returns in this dynamic asset class.