The amount of auto insurance you need in Texas depends on various factors such as your driving habits, the value of your vehicle, and your financial situation. In Texas, the minimum required coverage includes liability insurance to cover bodily injury and property damage caused by you in an accident. However, it is recommended to consider additional coverage options such as comprehensive and collision coverage to protect yourself and your vehicle in case of accidents, theft, or natural disasters.

It is important to assess your individual needs and risks when determining the amount of auto insurance you need in Texas. Factors such as the frequency of your commute, the area you live in, and the value of your assets should all be taken into consideration when selecting the appropriate coverage levels. Consulting with an insurance agent can help you determine the right amount of coverage to adequately protect yourself and comply with legal requirements in Texas.

The amount of auto insurance you need in Texas today depends on several factors, including your financial situation, driving habits, and the value of your vehicle. In Texas, drivers are required to carry a minimum amount of liability insurance to cover damages they may cause in an accident. This includes $30,000 per person for bodily injury, up to $60,000 per accident, and $25,000 for property damage. While this minimum coverage may be sufficient for some drivers, it may not provide enough protection in the event of a serious or costly accident.

To determine how much auto insurance you need in Texas today, it's important to consider additional coverage options beyond the state's minimum requirements. Comprehensive and collision coverage can help pay for damages to your own vehicle regardless of fault in an accident. Uninsured/underinsured motorist coverage can protect you if you're involved in an accident with a driver who doesn't have enough insurance or no insurance at all. Considering the high costs associated with medical bills and repairs following a car crash, having adequate auto insurance coverage is essential for protecting yourself financially and ensuring peace of mind on the road.

Importance of adequate auto insurance coverage

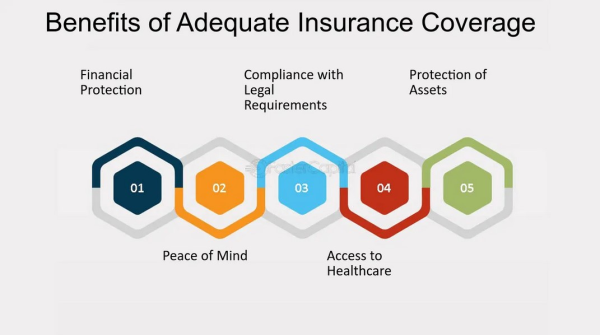

Auto insurance coverage is crucial for drivers in Texas, where accidents are a common occurrence on the busy highways and roads. In this vast state, with its sprawling cities and expansive rural areas, having adequate auto insurance can provide financial protection in the event of an unexpected collision or damage to your vehicle. Texas law also requires drivers to carry a minimum level of liability coverage to ensure that they can cover the costs of damages or injuries they may cause to others while on the road.

Moreover, with rising healthcare and repair costs, having comprehensive auto insurance coverage in Texas can help alleviate the burden of expenses associated with accidents. Adequate coverage not only protects you from potential lawsuits and medical bills but also provides peace of mind knowing that you have a safety net in place during uncertain times. Additionally, given the unpredictable nature of driving conditions and other motorists' behaviors on Texan roads, ensuring that you have sufficient coverage can safeguard your financial well-being and assets in case of an unforeseen accident.

In conclusion, investing in proper auto insurance coverage is an essential aspect of responsible driving in Texas. By meeting the state's minimum requirements for liability coverage and considering additional options such as collision or comprehensive insurance, drivers can protect themselves from potentially devastating financial consequences following an accident. Whether you live in bustling urban centers like Houston or Dallas or traverse the more remote regions of West Texas, having adequate auto insurance coverage is a wise decision that offers both legal compliance and financial security for any driver on Texan roads.

Having adequate auto insurance coverage in Texas is crucial for several reasons. Firstly, Texas law requires all drivers to carry a minimum amount of liability insurance to cover any damages or injuries they may cause in an accident. Failing to have this coverage can result in hefty fines and legal consequences. Additionally, having sufficient auto insurance can provide financial protection in the event of a car accident, ensuring that you are not left with significant out-of-pocket expenses for repairs or medical bills.

Furthermore, Texas has a high rate of uninsured motorists, so having comprehensive coverage can protect you from potential losses if you are involved in an accident with someone who does not have insurance. It also provides peace of mind knowing that you are adequately protected in various scenarios on the road. Overall, investing in adequate auto insurance coverage is a smart decision that can safeguard your finances and well-being while driving in Texas.

Minimum Liability Coverage in Texas

In Texas, the minimum liability coverage required for auto insurance is $30,000 per person for bodily injury, $60,000 per accident for bodily injury, and $25,000 per accident for property damage. This coverage is often referred to as 30/60/25. It's important to note that these are just the minimum requirements set by the state, and many experts recommend purchasing higher levels of coverage to protect yourself in case of a serious accident.

When determining how much auto insurance you need in Texas today, it's essential to consider your individual circumstances and assets. If you have significant savings or valuable assets that could be at risk in a lawsuit following an accident, it may be wise to opt for higher liability limits or additional coverage options like comprehensive and collision insurance. Ultimately, choosing the right amount of auto insurance coverage involves balancing affordability with adequate protection for yourself and your assets.

Living in Texas, it is essential to understand the importance of having adequate auto insurance coverage, particularly minimum liability coverage. In Texas, drivers are required to carry a minimum amount of liability insurance to cover any damages or injuries caused in an accident. The state's minimum liability coverage includes $30,000 for each injured person, up to a total of $60,000 per accident for bodily injury and $25,000 for property damage per accident.

It is crucial for drivers in Texas to assess their individual needs and circumstances when determining how much auto insurance coverage they need. While minimum liability coverage may meet the legal requirements set by the state, it may not be sufficient in providing full protection in case of a serious accident. Factors such as driving habits, vehicle value, and personal assets should be taken into consideration when deciding on appropriate levels of coverage. It is recommended that drivers consider purchasing higher limits or additional types of coverage beyond the state's minimum requirements to ensure adequate financial protection in the event of an accident.

Additional Coverages to Consider

When it comes to determining the amount of auto insurance coverage you need in Texas, there are several additional coverages to consider beyond the basic liability coverage required by law. One important consideration is uninsured/underinsured motorist coverage, which can protect you in case you are involved in an accident with a driver who does not have sufficient insurance to cover your damages. This coverage can help ensure that you are not left financially vulnerable if the at-fault driver cannot fully compensate you for your losses. In Texas, where a significant number of drivers may be uninsured or underinsured, this type of coverage is particularly valuable.

Another important additional coverage to consider is personal injury protection (PIP), which can help cover medical expenses and lost wages for both you and your passengers regardless of who was at fault in an accident. PIP can provide crucial financial assistance after an accident by helping offset medical bills and other costs that may arise from injuries sustained in a car crash. Additionally, comprehensive and collision coverage are essential considerations when deciding on the amount of auto insurance needed in Texas. Comprehensive coverage can protect against non-collision incidents such as theft or vandalism, while collision coverage helps pay for damage to your vehicle resulting from a crash with another vehicle or object. By carefully evaluating these additional coverages along with the minimum liability requirements set by Texas law, drivers can ensure they have adequate protection on the road.

When determining how much auto insurance you need in Texas, it's important to consider additional coverages beyond the state's minimum requirements. One key coverage to consider is uninsured/underinsured motorist coverage, which can protect you if you're involved in an accident with a driver who doesn't have enough insurance to cover your damages. This coverage can be particularly valuable in Texas, where a significant number of drivers are uninsured.

Another important coverage to consider is comprehensive coverage, which can help protect your vehicle from non-collision related incidents such as theft, vandalism, or weather damage. Given the unpredictable nature of these events, having comprehensive coverage can provide peace of mind and financial protection. Ultimately, the amount of auto insurance you need will depend on factors such as your driving habits, the value of your vehicle, and your risk tolerance. Consulting with an insurance agent can help you determine the right level of coverage for your specific needs in Texas.

Factors that Influence Coverage Needs

There are several factors that influence the amount of auto insurance coverage you need in Texas. One important factor is the value of your vehicle - the more expensive your car, the more coverage you may want to consider. Additionally, your driving record and history of accidents can also impact your coverage needs. If you have a history of accidents or traffic violations, you may want to opt for higher coverage limits to protect yourself financially.

Another key factor is your personal assets and financial situation. If you have significant assets that could be at risk in the event of a lawsuit resulting from a car accident, it may be wise to choose higher liability limits to protect yourself from potential financial losses. Ultimately, it's important to carefully evaluate these factors and consider your individual circumstances when determining how much auto insurance coverage you need in Texas.

Determining the amount of auto insurance coverage needed in Texas is influenced by several factors. Firstly, the state’s minimum legal requirements play a significant role in setting a baseline for coverage needs. In Texas, drivers are required to have at least $30,000 per person and $60,000 per accident for bodily injury liability, as well as $25,000 for property damage liability. This sets a standard that many drivers adhere to when selecting their insurance coverage levels. Additionally, personal financial considerations such as income level and assets owned can also impact the amount of coverage deemed necessary. Individuals with higher incomes or valuable assets may opt for higher coverage limits to protect themselves in case of a costly accident.

Another factor influencing auto insurance needs in Texas is the type of vehicle being insured. More expensive or newer vehicles may require comprehensive and collision coverage to protect against damages from accidents or theft. The age and condition of the vehicle can also influence insurance needs; older cars may only require basic liability coverage while newer models may warrant additional protection. Furthermore, personal driving habits and history play a crucial role in determining how much auto insurance is needed. Drivers with a record of accidents or traffic violations may choose to increase their coverage levels to mitigate potential financial risks associated with future incidents on the road.

In conclusion, when considering how much auto insurance one needs in Texas today, it is essential to evaluate various factors that could impact individual circumstances. From legal requirements to personal financial situations and vehicle considerations, there are multiple elements that influence the appropriate level of coverage needed for adequate protection on the road. By taking into account these factors and assessing one's unique situation carefully, drivers can make informed decisions about their auto insurance needs to ensure they are adequately covered in any unexpected eventuality while complying with state laws and regulations.

Recommended Coverage Levels for Different Drivers

Living in Texas, determining the appropriate coverage levels for auto insurance can be a daunting task considering the diverse driving conditions across the state. For young and inexperienced drivers, opting for higher coverage levels is crucial to protect against potential accidents and liabilities. This demographic group often faces higher insurance premiums due to their lack of driving history and increased risk of being involved in accidents. Additionally, having comprehensive coverage can provide peace of mind for both the driver and their families knowing that they are financially protected in case of an unforeseen event.

On the other hand, seasoned drivers with a clean driving record may find it more cost-effective to opt for lower coverage levels while still meeting the mandatory requirements set by Texas law. These individuals have accumulated years of experience on the road which reduces their likelihood of being involved in accidents compared to younger drivers. By choosing lower coverage levels, they can save on insurance premiums without compromising their financial security or legal obligations. However, it is important for all drivers in Texas to carefully evaluate their individual needs and circumstances when selecting auto insurance coverage to ensure adequate protection on the road.

Overall, recommended coverage levels for different drivers in Texas should be personalized based on factors such as age, driving experience, vehicle type, and budget constraints. While there are minimum requirements set by the state that all drivers must adhere to, it is essential to consider additional coverage options like collision and comprehensive insurance depending on individual risk factors. By striking a balance between sufficient coverage and affordability tailored to one's specific situation, drivers can navigate Texas roads confidently knowing they are adequately protected against potential risks while staying compliant with legal obligations.

The recommended coverage levels for auto insurance in Texas can vary depending on the individual driver's circumstances. Generally, it is advisable to have at least the minimum state-required liability coverage, which in Texas is 30/60/25. This means $30,000 for bodily injury per person, $60,000 for bodily injury per accident, and $25,000 for property damage.

However, it is often recommended to consider higher coverage limits or additional types of coverage such as comprehensive and collision insurance to protect against a wider range of risks. Factors like the value of your vehicle, your driving record, and personal assets should also be taken into account when determining the appropriate level of coverage.

Ultimately, it is important to assess your individual needs and budget when deciding how much auto insurance you need in Texas. Consulting with an insurance agent can help you understand your options and make an informed decision based on your specific situation.

Understanding Uninsured/Underinsured Motorist Coverage

In Texas, having adequate auto insurance coverage is essential to protect yourself in case of accidents involving uninsured or underinsured motorists. Uninsured motorist coverage provides financial protection if you are involved in an accident with a driver who does not have insurance. This coverage can help pay for medical expenses, lost wages, and vehicle repairs that would otherwise have to come out of your own pocket.

Underinsured motorist coverage is also important as it helps cover the gap between the at-fault driver's insurance limits and the actual cost of damages incurred in an accident. Without this coverage, you could be left with significant out-of-pocket expenses if the other driver's insurance is insufficient to cover all your costs. It is recommended to consult with an insurance agent to determine the right amount of uninsured/underinsured motorist coverage based on your individual needs and budget.

In today's unpredictable world, the importance of having adequate auto insurance coverage in Texas cannot be overstated. With the increasing number of uninsured and underinsured motorists on the roads, it is crucial to understand the significance of having Uninsured/Underinsured Motorist (UM/UIM) coverage in your policy. This type of coverage protects you in case you are involved in an accident with a driver who either has no insurance or insufficient insurance to cover your expenses.

Having UM/UIM coverage ensures that you are not left financially vulnerable in situations where the other party is unable to pay for damages or medical bills resulting from an accident. In Texas, where minimum liability requirements are relatively low compared to other states, investing in additional UM/UIM coverage is a wise decision. It provides peace of mind knowing that you have extra protection against irresponsible drivers who do not have sufficient insurance to cover their liabilities. Ultimately, understanding and prioritizing UM/UIM coverage when selecting auto insurance can make all the difference in safeguarding yourself and your assets on the road.

Conclusion

As we conclude our discussion on the importance of auto insurance in Texas, it's crucial to emphasize that having adequate coverage is not just a legal requirement but a necessity for financial security and peace of mind. The unpredictable nature of accidents and the rising costs of medical treatment make having sufficient auto insurance imperative in protecting yourself and your assets.

Moreover, beyond the basic liability coverage mandated by law, considering additional options like comprehensive and collision coverage can provide added protection against unforeseen events such as theft, vandalism, or natural disasters. It's essential to assess your individual needs and potential risks to determine the right level of coverage that will safeguard you in various situations. Remember, investing in comprehensive auto insurance today can save you from significant financial burdens in the future if an accident occurs.